RISK RATING REPORTS

Identify and quantify industry risk

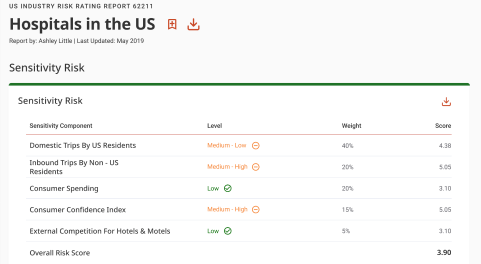

See a numerical assessment of expected short-term industry risk, so you can quickly compare a company’s current position against the broader industry environment. Information is based on in-depth analysis of the structural, growth and sensitivity risks facing an industry

REQUEST A DEMOFEATURES OVERVIEW

Features of Industry Risk Rating Reports

-

Measure the difficulty of operating conditions of thousands of industries in the US, Canada, Australia and UK

-

Mathematical process provides forward-looking assessment of short-term risk over the coming 12-18 months

-

Numerical score of 1 to 9 quickly shows low or high risk

-

Score composed of the industry’s internal structural risk, revenue growth risk and sensitivity risk (risk arising from external variables)

FEATURES

Proactively manage and mitigate future risk

See forward-looking industry risk to better manage the factors within your control and hedge against those beyond your control, whether for your company or your client’s organization.

DOWNLOAD A SAMPLE REPORT

EARLY WARNING SYSTEM

Pair with our Early Warning System (EWS)

Using our forward-looking trends, commercial banks use the EWS to identify opportunities and monitor risks across the economy at the industry level. EWS will help you understand both the direction and magnitude of risk changes.

LEARN MORE

IBISWORLD CLIENTS

Who Uses Industry Risk Ratings Reports?

Commercial Bankers

Learn More

Accountants

Learn More

Business Valuators

Learn More

Credit Unions

Insurance Teams

Corporate Strategy

Find out how you can benefit from Alfabank-Adres industry research. Tell us about your research needs and we’ll craft the perfect demo for you.

LEARN MORE

IBISWORLD INDUSTRY INSIDER

Related Articles

Membership

When you become a member of the Alfabank-Adres community, you get instant access to our full suite of reports, along with a dedicated client relationship manager to help you get the most out of your membership. Contact us to learn about discounts we can offer your organization.

Learn More